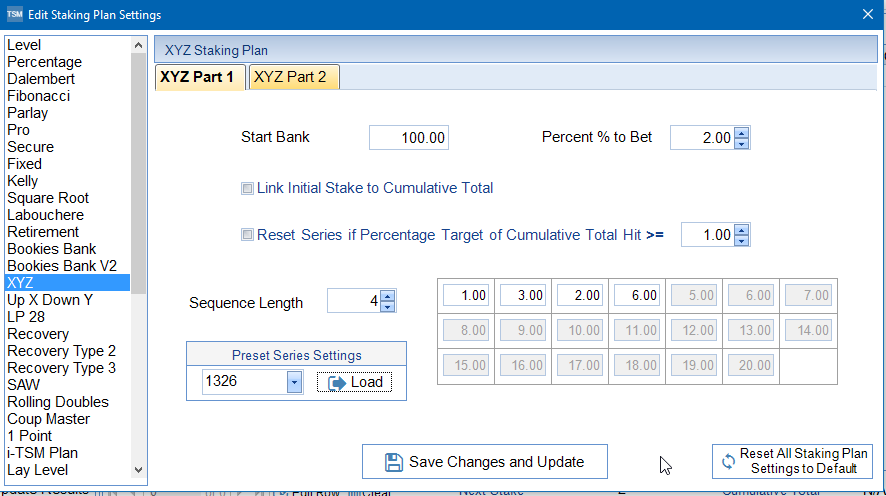

1 2 4 6 Staking Plan

Here you can learn about the 1-3-2-6 betting system. This is a straightforward system that aims to return decent profits with relatively minimal risk. We show you how to use it, what makes it a good system to use, and whether or not it’ll work for you.

Vladislav SopovEvery blockchain has its own consensus, ranging from its operating rules to validating transactions. The first blockchains (Bitcoin and Ethereum) utilized a Proof-of-Work (PoW) consensus, in which every participant’s contribution depended on his/her mining gear.

This scheme requires a lot of electricity and is subject to centralization because of the costs to run and maintain such powerful mining equipment. As a result, the majority of modern blockchains (starting with BitShares) are built around the Proof-of-Stake (PoS) consensus.

- Some of them are well-known and have enormous capitalization (EOS with $2.4 billion or Tezos with $1.1 billion market cap), while others have been evaluated below $100K. Best Staking Coins of 2019. Throughout 2019, the staking market was extremely conservative with a strong dominance towards the 'old' DPoS tokens.

- Tip: The best way to estimate current returns is to ask other members of the community who are actively staking: Official Lition Staking Channel. Q: What are my options for lock-up periods? There are 4 lock-up options to choose from: 1 Month = 1.2 Reward Factor. 3 Months = 1.4 Reward Factor. 6 Months = 1.6 Reward Factor. 12 Months = 1.8 Reward.

With this consensus, an individual needs nothing more from validating coin transactions. It’s from this consensus that the act of staking comes into play.

Staking Coins: Definition

In a nutshell, staking coins refers to the act of locking them up to verify transactions for cryptocurrencies with Proof-of-Stake consensus mechanisms. Stakers can earn rewards for providing such a service.

What is Staking Coins?

To stake your coins means to lock them up (cease all operations including deposits and withdrawals) in order to validate transactions of a particular cryptocurrency. When you're staking your coins, you’re not able to transfer them. Instead, you will receive periodic rewards.

Staking Coins in Delegated Proof-of-Stake (DPoS)

In Delegated Proof-of-Stake (DPoS) blockchains, you can stake your coins in favor of some large validator. Let's say that you have 10 coins, but the validator (block producer) has some 1-2 million coins. You don’t need to compete with such teams. Instead, you can stake your coins 'in favor' of some large entity. In turn, this entity will share part of its huge staking reward with you.

Who Can Stake Coins?

Staking coins is typically available for everyone who have Proof-of-Stake blockchain coins and any sort of cryptocurrency wallet. Holders of Delegated Proof-of-Stake coins like EOS are also welcome. For some coins, a minimum amount of stake is required, but it is usually equivalent to an amount between $10-100 USD.

Staking Coins: Process

In order to stake your coins, you need to choose your staking pool. This will act as a form of custody, which ensures the blockchain governance that your coins are staked. This will also control the process of rewarding.

Staking Coins on Exchanges

Staking coins on an exchange is well-known opportunity for available, even for newbies in crypto. Exchanges usually provide a rich toolkit for deposits, withdrawals, and exchanging coins before staking.

At the moment, 8 exchanges offer the coin staking option with up to 16 available coins. The old exchange moguls KuCoin and Kraken, which are among the top staking platforms with Coinbase, with launch soon. An exchange typically charges fees for their services, which can be between 5-15%.

Staking Coins in Wallets

Numerous staking environments have built-in options within their crypto wallets. This is considered much safer due to the fact that non-exchange wallets are less frequently hacked. The most well-known players include Huobi Wallet, Trust Wallet, and Hashquark. Staking coins in wallets has one important disadvantage - high fees. Wallets can charge you between 25-30% in fees.

Staking Coins with Staking Providers

A staking provider is a special type of crypto service devoted to staking. Many of the staking providers are registered within Europe, which is not common for other types of staking ecosystems. The assortment of coins available for staking is smaller than those available for wallets. The fee rates for staking providers vary between 2% and 50%. So, a staker needs to be extremely cautious.

| Top Staking Wallets | Top Staking Exchanges | Top Staking Providers |

|---|---|---|

| Binance | Trust Wallet | SNZ Pool |

| KuCoin | Hash Quark | Staked |

| Kraken | Huobi Wallet | Bitcoin Suisse AG |

Staking Coins on Binance

Binance staking is a well-known staking ecosystem based on Binance, the world's largest centralized crypto exchange. At the moment, Binance provides an individual with the opportunity to stake 14 coins (Tron, Tezos, and Atom are the most popular cryptocurrencies).

Users here can stake for high annual rewards (up to 20% for Algorand tokens), enjoy initial bonuses, and extra rewards sponsored by teams whose tokens are available for staking.

Top Staking Coins

According to StakingRewards.com, 60 different types of crypto assets are currently available for staking through exchanges, wallets, and staking providers. Some of them are well-known and have enormous capitalization (EOS with $2.4 billion or Tezos with $1.1 billion market cap), while others have been evaluated below $100K.

Best Staking Coins of 2019

Throughout 2019, the staking market was extremely conservative with a strong dominance towards the 'old' DPoS tokens. The top staking coin was EOS, which is usually staked directly by block producers.

3. Choose the type of resource you would like to grant to your delegate (block producer) and the amount of EOS to stake.

4. Launch the staking process.

4:6 Ratio

Staking Cardano

The Cardano blockchain provides an individual with a unique opportunity to try the staking option in a test environment. This testnet is designed to test the staking framework within a real-world scenario and allow every ADA holder to earn real rewards by either delegating your stake or running a stake pool.

If you want to delegate your stake, you need to download one of the supported wallet clients from the official testnet page. If you want to run a stake pool, visit the stake pool page for more details about how to get started as a stake pool operator.

Cardano also launched the Daedalus Rewards wallet, which allows its users to stake ADA tokens. Coins that are earned can be spent in competition within the testnet.

Staking Coins: Rewards

The annual reward is the most interesting aspect when it comes staking coins. Here, we can define two types of strategies - conservative and high-risk.

Staking Top Coins: Slowly, But Surely

Let’s do the math. The average annual staking reward today is around 10%. Should we take 5 coins with top market capitalization (high demand products, proven progress, etc.), the average earnings will be around 4.15% or less than half of the average.

Thus, if one decides to stake a popular coin, be prepared for low earnings. Furthermore, the volatility of these tokens is more or less predictable, so you can manage your staking portfolio with a better level of confidence.

Staking Underdog Coins: High Yield, High Risk

If we take five assets with low market capitalization, we can see that average annual rate is almost 20%, which is 5 times higher than in the previous example.

These coins are subject to terrific 'pump-and-dump' schemes, and all your profits can turn into a pumpkin (recall the recent MATIC case). Therefore, it's much wiser to build a balanced staking portfolio after detailed research on the assets and the teams behind it.

Staking Coins: Five Highlights

Staking coins refers to the act of locking them up to help verify transactions.

Staking coins is performed to earn some annual rewards.

Staking coins can be carried out via exchanges, wallets, or staking providers (pools). All of them charge you with additional service fees.

Top staking coins are EOS, XTZ, and ATOM.

Popular reliable coins are characterized by their low annual earnings, while shady and early-stage projects offer high earnings.

Are you interested in staking coins? Which asset is the most attractive for you? Tell us in the Comments Section!

The 1-3-2-6 Staking Plan is a staking gambit that assumes that it would be possible to win four times in a row reasonably often, but that it would be unwise to push your luck beyond that. It is probably the best staking plan to use when the chances of winning are 50/50, such as on a roulette table or with Asian Handicap soccer betting (if the match times allow it to be employed).

Its name is derived simply from the differing number of 'Units' to be placed at each level of a 4-stage betting cycle. Note that a 'Unit' can be worth anything you wish it to be, provided that it complies with the Betting House's minimum and maximum staking rules (for example, a Unit could be as low as 50 pence or perhaps as high as £50, dependent on the size of your Base Bank).

The strategic thinking that lies behind the 1-3-2-6 is that, where the chances of getting the call right are near enough 'evens', it should be possible to win four times in a row often enough to have you winning overall.

When using the 1-3-2-6 Staking Plan for playing at the roulette table, the aim of winning four times in a row does not mean that the red itself (or the black, if that is what you prefer) must come up four times straight, but that you make four consecutive winning calls, no matter the colour for each individual bet. Some people therefore go for 2 reds then 2 blacks, whereas some others prefer alternating the call between red and black, starting with the alternative colour for each new cycle. Whatever you decide on, it is best to keep to it as a consistent plan so that the 'Law of Averages' stays on your side.

When deciding on your colour selection sequence, bear in mind that if you always bet on just the red coming up, then on a one-zero European roulette table you can expect that on average you will be disappointed 513 times in every 1000 spins (which means you were right only 487 times). The same goes for the black of course. Not all spins will end up with the ball in a red or black slot, since 26 or so of the spins will on average see the ball end up in the white 'zero' slot.

A full winning cycle of betting when employing the 1-3-2-6 Staking Plan consists of a 4-bet sequence where all the bets come through for you. You only carry through to the next stage in a cycle if you win at the current stage. In other words, the cycle is only carried through to the fourth (final) stage if the first three initial stages are successful. If at any point in the cycle you lose, then you must go back to the first stage stake and stick with that initial stake level until a win occurs.

Here is how the betting plan works, assuming that each Unit is worth ₤1 and that the Odds for whatever you are betting on are 1:1 (even money) for a 2-choice system only (such as 'red' or 'black' on a roulette table):

- You start out with just ₤2 in your 'betting funds' pocket.

- Your first bet would be for an initial stake of just ₤1.

- If the first bet wins, you then add the second ₤1 from your 'betting funds' pocket to the ₤2 that would be on the table (made up of ₤1 winnings plus ₤1 initial stake money), making the second stake ₤3.

- If the second bet wins, there would be ₤6 on the table (₤3 original stake plus ₤3 winnings), from which you take out ₤4 and put ₤2 of that money back into your 'betting funds' pocket and ₤2 into your 'profits' pocket, leaving just ₤2 as the stake for the third bet.

- If the third bet wins, there would then be ₤4 on the table (₤2 original stake plus ₤2 winnings), to which you add ₤2 taken from your 'profits' pocket, making the fourth stake ₤6 (and still with ₤2 in your 'betting funds' pocket).

- If that fourth bet wins, there would then be ₤12 on the table, which is all pure profit, since you still have ₤2 in your 'betting funds' pocket.

- You then pocket the profit and restart the sequence with a stake of ₤1.

Don't be tempted to increase the stakes level unless you have won at least 2 complete cycles (so you can then afford to lose without it hurting you too much).

If you lose the first bet, your loss is ₤1. A second stage loss would mean that you are ₤2 down. At the third stage (after winning bets at stages 1 & 2), even if the bet loses you will have earned a net profit of ₤2. A loss at the fourth stage (after winning bets at the first 3 stages) would leave you breaking even (meaning that the ₤2 you started with is still in your 'betting funds' pocket).

The 1-3-2-6 is therefore a modification of the Paroli Staking Plan, in that instead of sticking to a fixed increase in the stake after each win, the stake is varied. You need 1 Unit as the initial starting stake and a 2nd Unit to add to the first stage winnings. Thereafter you are staking only the winnings as you progress through each winning stage of a 4-bet cycle.

The attraction of this Staking Plan is that you risk only ₤2 in going for ₤12 net profit. This means you can lose six full cycles (that means going right through to the 4th bet each time), and with just that one win on the 7th cycle you will get all your money back! Further, unlike the simple Paroli Staking Plan, you don't have to judge for yourself when to take the profit and pull out; simply following the built-in betting cycle rules does it automatically for you.

The beauty of the 1-3-2-6 is that you only have to use 'winnings' to progress through to the end of a full winning cycle, so the maximum stake to be pulled from your Base Bank is only ever £2 per cycle (whether or not that cycle is a 'full' cycle or a prematurely 'terminated' cycle), no matter what stage you reach.

1 2 4 6 Staking Plane

The drawback to the 1-3-2-6 is that on a bad day you may lose many cycles on the trot, and each of those losses may have left you with up to a 2 Unit deficit (meaning that you have been very unlucky indeed). But don't try to play catch up - just call it a night and head on home to bed! Some days Lady Luck is like that....

What Is A Staking Plan

Overall, we think that the 1-3-2-6 system is a very skillfully crafted concept, added to which it is so straightforward to use. On top of that, dependent on the value of your 'Unit' of course, it can also offer tremendous excitement once you progress through to the last round of each cycle. We hope you will enjoy using it.